Principals/Vice-Principals (P/VP)

Learning Centre

Annual Member Update

Since the ONE-T Benefits Plan was established over seven years ago, we’ve built a Plan that currently serves more than 8,400 P/VP Members and covers 19,228 dependents.

ONE-T is managed by a Board of Trustees appointed by:

• The Crown (government)

• CAEAS-ECAB and Principals/Vice-Principals

• Trustee Associations

There are two staff – an Executive Director and Administrator – who manage the day-to-day operations of the Plan.

This Update has been prepared for ONE-T P/VP Members so you can learn about the key highlights from 2024 and what’s coming up for the Plan in 2025.

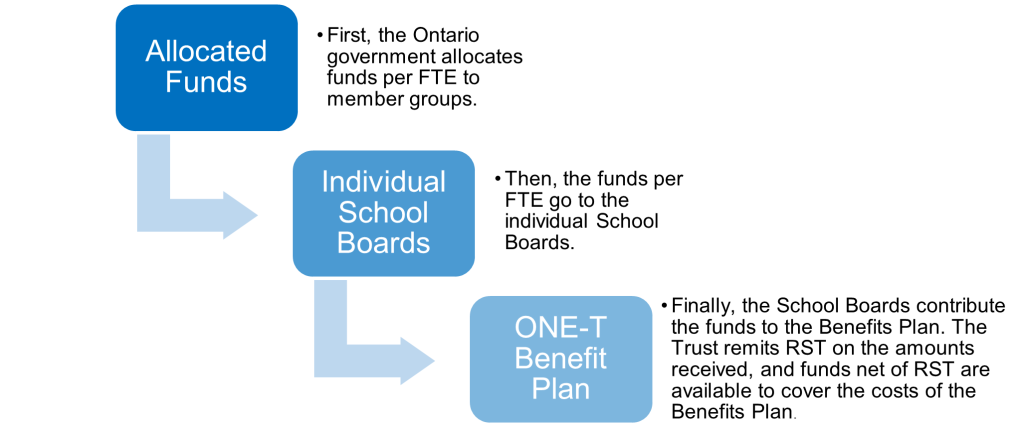

Plan Funding

Being transparent with Members about Plan funding and management is essential. During our 2024 fall webinars, we explained how ONE-T is funded – so you can better understand where the money for your coverage is coming from and how much is available each year. Here’s a snapshot:

ONE-T Trustees do not have control over how much funding is provided by the Ministry of Education.

However, the Trustees use several measures to ensure the Plan remains in sound financial shape – one of which is to review Plan costs and the available funding from the government each year to determine if changes or enhancements can be made. The goal is always to balance Member benefits and Plan sustainability so that the ONE-T Plan can continue to support current and future Members.

Plan Financials

It can be challenging to manage the Plan’s financials since it depends on the funding that ONE-T receives for P/VP Members. Recent funding increases have been negotiated by the P/VP Associations and the Crown; however, Plan costs continue to increase year after year and have been outpacing the funding increases.

The pandemic is now a couple of years behind us, and we are starting to see its lasting impacts. In 2024, health and dental costs continued to rise at a pace even higher than in 2023. On top of that, inflation and rising prices mean that many health and dental products and services cost more than before.

Overview of claim costs in 2024

Drugs

$18,446,000

Dental

$17,940,000

Paramedical

$10,278,000

Vision

$3,312,000

Other health

$2,375,000

One of the ways we review the Plan’s financials each year is through actuarial valuations, which measure the Plan’s projected revenues against its projected costs over a short horizon. When the projections show the financial position of the Trust falling below a mandated minimum threshold, the Trustees must work diligently to make changes to manage the Plan costs so it remains sustainable within the funding provided.

Introducing Member Premium Contributions

The number of Member claims and their cost continues to rise faster than government funding, so the Trustees had to make the difficult but necessary decision to share a portion of Benefits Plan premiums with P/VP Members starting March 1, 2025.

We have seen other plans in the education sector use premium sharing for some time, and believe it is a necessary measure to ensure the Plan can remain both affordable and sustainable for the years ahead.

Beginning on March 1, 2025, a deduction will be taken from each pay to cover 6% of the Health and Dental premiums. You can visit the Learning Centre to see what your monthly payroll deduction will look like.

Member Service

In 2023 and early 2024, some Members experienced challenges with submitting claims and receiving prompt payment from Canada Life. We worked with Canada Life to resolve these challenges and bring service levels back to where they should be, and we’re happy to report that those efforts are paying off.

We use several metrics to track Member service levels, which Canada Life is currently meeting or exceeding in all areas.

Here are some highlights from 2024:

• Calls were consistently answered within 60 seconds.

• Claims were processed within 7 days: Canada Life has generally surpassed its

target and, at the end of 2024, was very close to reaching 100%.

We’re pleased with the progress and will continue working with Canada Life to ensure you receive efficient and reliable services.

If you feel a concern hasn’t been adequately addressed by Canada Life, you can email us at info@one-t.ca, and we’ll look into it for you.

Communication

Connecting with Members will always be one of our top priorities. In 2024, we focused on bolstering information and resources that can help you make the most of your Benefits Plan.

Health Care Spending Account (HCSA) video series

Your HCSA is an important part of your Benefits Plan that can help you cover costs when submitting a claim… but the process to submit an HCSA claim can be tricky. That’s why we created a short video series that explains, step by step, how to submit a claim to your HCSA. You can find it on our HCSA page!

October webinars

We hosted our annual webinars in late October, giving our ONE-T team and Trustees a chance to connect with Members on important Plan matters. In case you missed it, or if you would like a recap, the webinar recording and a Q&A are available in the Learning Centre.

The ONE-T website

Our website remains a go-to resource for Members. We post timely updates throughout the year, including blog posts that provide you with insights about Plan features, Plan changes, and links to helpful resources. Visit the Learning Centre and scroll through to find posts on emergency travel medical coverage, updates to your Plan, and more!

2024 Milestones

Plan updates

· Trustees have implemented changes to the Plan to maintain sustainability and affordability as health and dental costs continue to rise and outpace funding increases

New blog posts

· Spotlight on your emergency travel medical

· Could it be… fraud?

· Plan updates Q&A

How to submit a claim to your HCSA

· Video series on how to submit a claim under different scenarios

· Scenarios include: the one-claim approach, the HCSA-only approach, and the Special Expenses approach

Webinars

· Conducted three sessions with P/VP Members

· Talked about how ONE-T works; presentation from Canada Life; recent Plan changes

· Live Q&A session

Governance

· Cyber security review

· Reviewed our risk monitoring

· Contract renewals of several of our Service Providers

Investment strategy

· Investments in short-term GICs and institutional bond fund

Contacts

There are several service partners who work together with ONE-T to provide the overall experience for Plan Members. Here’s a helpful list of who to contact, depending on the nature of your question or request:

| Service provider | When to contact |

|---|---|

| Cowan (our Plan administrator) 1-888-330-4010 one-t@cowangroup.ca |

• Questions on enrolment, • To enroll in the Plan or make • To update personal information • To request tax slips • To access AD&D forms and • Anything related to your |

| Canada Life (our service provider for health, dental, and life insurance coverage) 1-866-800-8086 My Canada Life at Work |

• Questions about whether your • Questions about your claim – • Anything related to your health, |

| Cubic Health (FACET program for prior authorization) 1-844-492-9105 www.facetprogram.ca |

• Questions about drug claims • Issues related to the prior |

| Chubb (our Accidental Death & Disability insurer) |

• Members do not need to |

|

ONE-T For questions on ONE-T operations, contact Moe Renaud – Executive Director: |

• Questions about the ONE-T • To file an appeal • Questions related to operations and Service Provider service issues |

Search the Learning Centre

© 2026 Ontario Non-union Education Trust